What A Tariff Is And How It Impacts You

Written by Will Wigginton (4/30/25)

Prior to 2024, when I heard the word tariff, two things came to mind: (1) the Smoot-Hawley Tariff Act and (2) the repeated tariffs placed on the American colonies by the British Empire prior to the Revolutionary War, like the Stamp Act. Both of these examples led to disastrous results by the entity imposing the tariffs, leading me to believe that placing a tariff can only cause an economic downturn. While that is not always the case, it’s the typical outcome, especially in a modern world that relies upon interdependence, a global supply chain, and liberal trade policies. And, no, supporting liberalization in an economic context does not mean you’re a supporter of the Democratic Party, instead, it means you support the removal of economic barriers to enable free trade principles between countries.

Going back to the main point of the article, it’s necessary to define what a tariff actually is–-along with the advantages and disadvantages of employing this economic strategy. A tariff is a tax imposed by one country on goods imported from another country. It establishes trade barriers between countries, which raises prices, thereby reducing the available quantities of goods and services for the parties, and ultimately hindering the economic prospects of businesses and consumers by creating an economic burden on foreign exporters.

Now, this does not mean that tariffs are always a bad thing and should be ignored like the plague, but they should only be employed in temporary or uniquely strategic situations. Tariffs are a protectionist economic strategy—that is, they are typically utilized in situations where a country’s government deems it necessary to preserve the economic stability of certain domestic industries. A typical example of this in action is the farming industry, in which governments will place tariffs on food imports from trade partners in order to ensure that domestic farmers are having the best access to consumers, thereby creating economic growth. However, as mentioned previously, this type of strategy should only be used strategically, and should not be a permanent policy, as it can alienate current and potential trading partners, therefore reducing economic growth in a globalized economic system.

The typical counter-argument that I see by proponents of Trump’s tariff policies is that Americans should strictly buy from American corporations if they don’t want to pay an increased price on an imported good. The problem is that the reality of the situation is not even close to that simple. There are very few goods that cannot only be exclusively produced/manufactured in the United States, but can also maintain a necessary supply based on the demand that importing goods helps to offset.

For example: a common misconception propagated by pro-tariff individuals is that if you’re in the market for buying a car and don’t want to pay an increased price, simply buy an American-made car from a domestic brand like Ford. This is where the fact that the roots of the global supply chain are nearly impossible to pull from the ground comes into play, proving why imposing widespread tariffs should be considered economic suicide. There are NO automobiles in existence that have had 100% of its parts come from and manufactured within the United States. The figure below accentuates this point, as the highest percentage of parts used for vehicle manufacturing within the United States is Kia at 80%; however, that is with Canada included in the chart, meaning that in the absolute best-case scenario, there is no vehicle in the United States that had 80% or more of its parts manufactured exclusively within the United States–the same goes for vehicle assembly.

Source: USA Today

The point of this is that when someone tells you to just “buy American,” you can’t. No matter which store you walk into–whether it’s a grocery, video game, or hardware store, the products on the shelves were imported from another country, or had aspects of its development imported from another country. That’s the point of having a global supply chain. The economic interdependence that the world experiences today facilitates economic growth for countries like the United States. While it is undoubtedly an imperfect system, it’s the best option currently available, and protectionist tariff policies are nowhere close to being a more optimal alternative.

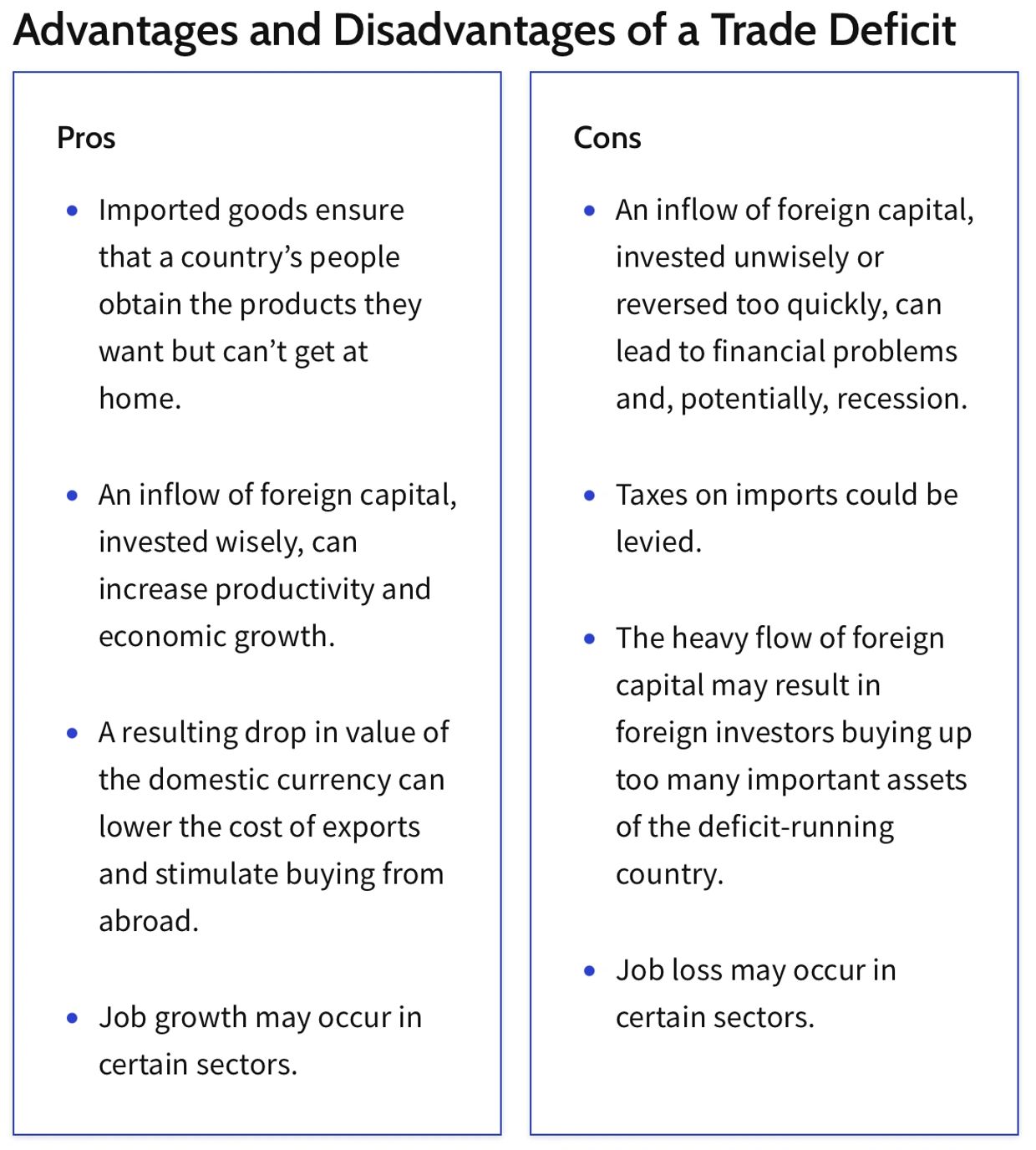

Another economic term that has been discussed ad nauseam by President Trump, which goes hand-in-hand with his administration’s perception of tariffs, are trade deficits. In short, a trade deficit means that one country is importing goods at a higher value from another country than it is exporting back to that particular state. Unfortunately, misinformation surrounding the concept, along with the word “deficit” having a negative connotation, means that many Americans perceive trade deficits the United States has with countries like China as inherently bad for economic prosperity, which is simply not the case. With that said, there are explicit disadvantages to having trade deficits with economic partners. The figure below helps to highlight the positives and negatives of the concept:

Source: Investopedia

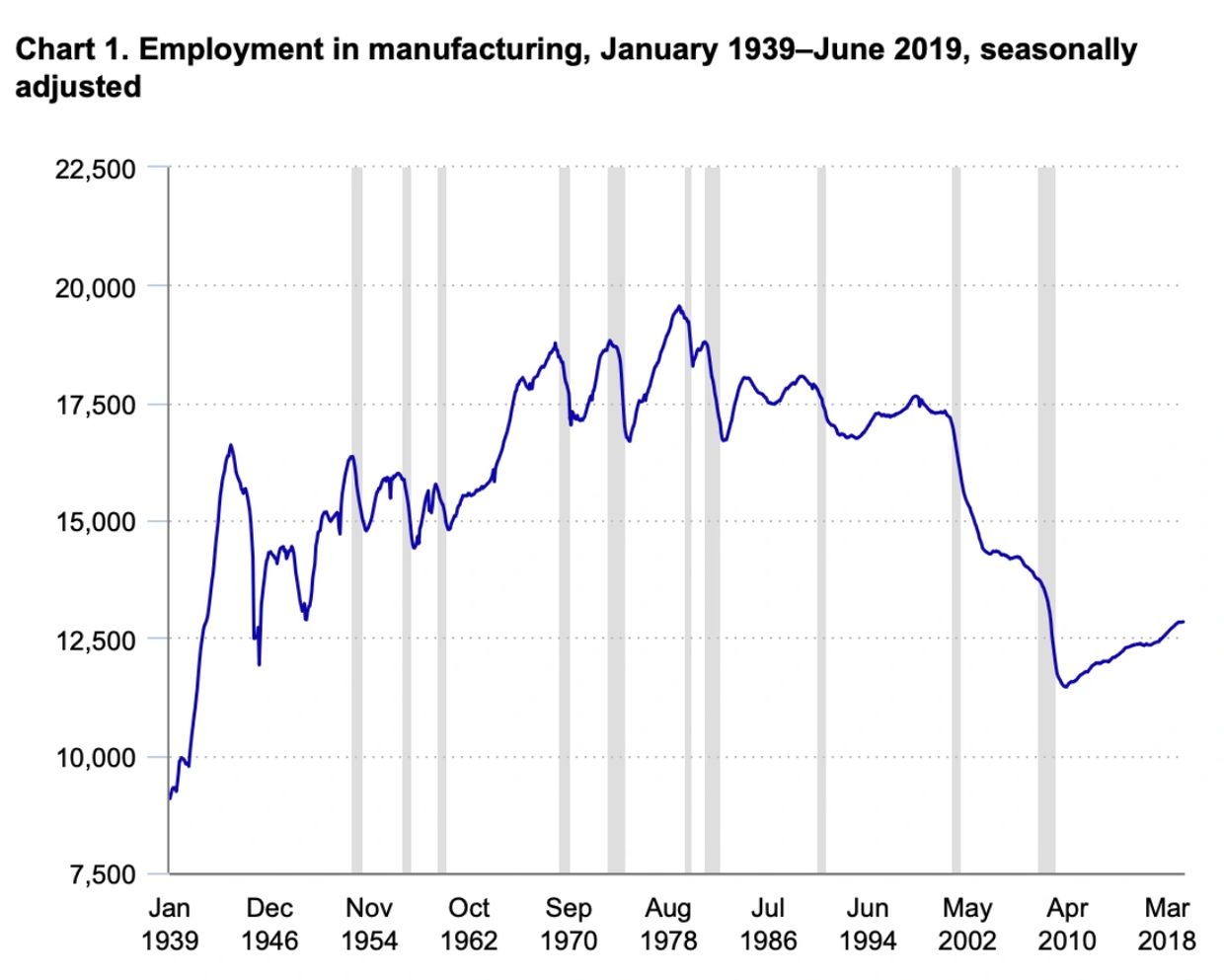

The main disadvantage of trade deficits, and a point of contention that President Trump has with them that I entirely agree with, is the fact that these deficits lead to decreased domestic jobs in the manufacturing sector. According to the U.S. Department of Commerce, in 2024, only about 13 million Americans worked in the manufacturing sector, making up 10.3% of the country’s GDP, but only 8% of the eligible population working in that field. The chart below highlights the decades-long decline in American manufacturing, which has been a growing issue throughout the years:

Source: U.S. Department of Labor Statistics

Besides decreased domestic manufacturing, trade deficits are not a bad thing. They’re typically a mutually beneficial situation. Consider this analogy: you go to a grocery store to buy food. You’re paying a supplier of that food money in order to obtain the item(s). It’s true that you lose money as a result of paying for the price of food, but you gain something that you didn’t have before: food. A trade deficit leads to a similar conclusion.

The United States buys products from a country like China to sell domestically. Yes, America is losing money as a result of purchasing the goods, but, in return, its consumers get to buy cheap yet high quality products. Therefore, the United States and its government/private businesses aren’t faced with the burden of building manufacturing plants, hiring and paying reliable employees to work in the plants, and subsequently selling goods at a higher price because of American labor laws (which are a good thing, don’t get me wrong).

The bottom line is that both parties to the exchange are getting what they want, making the outcome less of an actual “deficit,” but a way to foster economic growth.

Following the Trump administration’s widespread implementation of tariffs, which has continued to go back-and-forth in terms of severity, extreme economic uncertainty has ensued. The astronomical and historical tariffs Trump has placed on China (one of its largest trading partners, along with Mexico and Canada) will nearly freeze trade between the countries in the coming months. Since America is the one who imports from China much more than the contrary, American consumers will be faced with an extreme shortage in goods, which will cause prices to skyrocket at stores.

The value of Chinese exports to the United States is roughly $439 billion, good for over 13% of all imported goods into the United States. Moreover, blanket tariff rates placed on countries around the world, especially with Mexico and Canada, will have a similar effect on American consumers. As proof, shipping vessels carrying containers of goods incoming to the United States are only reaching 35-42% of capacity, meaning that once the current allotment of goods on store shelves run dry, they won’t be readily replaced. At that point, basic supply-and-demand principles will come into play.

I’ll leave you with this: free trade is the best economic policy a government can employ in the modern world. The United States implemented free trade principles following World War II and the country’s long-standing love affair with isolationism (the antithesis of free trade), was dead. As a result, the United States subsequently became the world’s most dominant economic and military superpower. Any person or government who aims to destroy the foundation of free trade and global interdependence policies is not one who has the best interests of the country they lead in mind, but is, simply put, misguided.

References: